epf i akaun investment

The Employees Provident Fund EPF launches the i-Lindung platform under the Members Protection Plan to facilitate the purchase of insurance and takaful products consisting of life and critical illness protection at affordable premium from Account 2. How to check if you are qualified.

How Epf Digitalising Its Customer Journey

Theyll send the code via SMS.

. Eligible EPF members can now benefit from the self-service i-Invest online platform within the EPF i-Akaun member portal. Only members up to the age of 55 are eligible for the Basic Savings amount before the EPF issues a release control. First Time Login i-Akaun Activation Forgot User IDPassword.

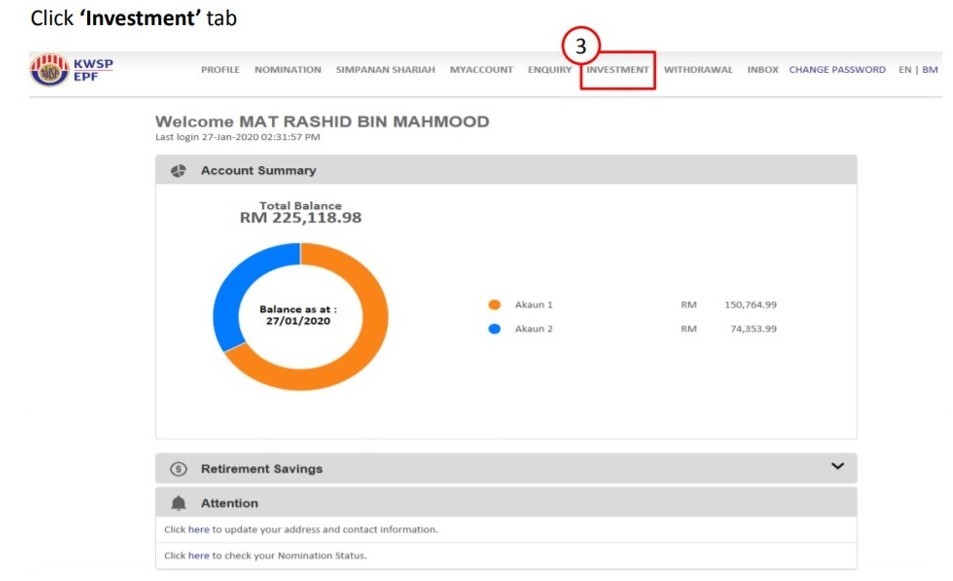

Visit any EPF offices together with a copy of the e-mailletter to collect the Activation Code. Amount that can be invested is 30 of the savings in excess of Basic Savings required in Account 1. 1 Log in to your EPF i-Akaun 2 Select Investment on the menu bar 3 On the buy screen select Principal then choose your fund s You can start investing with RM1000 4 Select Principal as your preferred Fund Management Institution FMI and complete your transaction Start investing EPFs i-Invest Funds.

Written by Tharmini Kenas. Ad Bei uns erhält jeder Kunde maximale Anlagequalität. 100 Swiss Made und digital.

Qualified EPF members can choose to invest into EPF-qualified unit trust funds with fund management institutions IPD appointed under the EPF-MIS. In a statement the EPF said members who wish to purchase insurance and participate in takaful products offered by EPF-approved insurance companies and takaful operators can do so via the i-Lindung platform within the EPF i-Akaun Member portal. True Wealth die Online Vermögensverwaltung.

True Wealth die Online Vermögensverwaltung. Invest Your EPF digitally with Principal Asset Management via FinAIMS Amelia Hong at 0 sales charge. Welcome to i-Akaun Member Frequently Asked Question FAQ i-Akaun Member Login.

The i-Invest facility was first launched back in August 2019 and sought to allow members to invest their EPF savings into unit trust funds from approved FMIs directly from their EPF i-Akaun portal. Press 0 to talk to the nice operator then answer some personal questions for identification purposes. 2021-02-16 The Investment Division manages the EPFs investment fund with two primary long-term investment objectives to preserve and enhance the value of capital from members contributions.

Minimum investment is RM1000. EPF will e-mail or mail you the details of your Activation Code for confirmation purposes. Who Can Apply Requirements Malaysians OR Permanent Residents PR OR.

100 Swiss Made und digital. What is i-Lindung. The protection offerings are available to EPF members with immediate effect.

You are a registered user of EPF i-Akaun. Epf i akaun investment. 22 rows No upfront fees will be imposed by FMI for investments transacted through i-Invest via EPF i-Akaun while for investments made through agents the upfront fee will be reduced from a maximum of 3 to a maximum of 15.

Here is the sample report -it is more comprehensive compared to EPF i-Invest report via i-Akaun. EPFs i-Invest in 4 simple steps. EPF i-Invest is Employees Provident Fund EPFs self-service online transaction platform which allows eligible EPF members with EPF i-Akaun to invest in EPF-qualified unit trust funds with their savings from EPF Account 1.

How To Invest 1 Login to EPF i-Akaun Member. Menu Search function on EPFs approved funds. The Benefits of Investing through EPF-MIS How to Invest The amount that can be invested is 30 of the savings in excess of the Basic Savings required in Account 1.

3 Select Hong Leong Asset Management. Via i-Invest members can choose to invest in unit trust funds offered by EPF-approved Fund Management Institutions FMIs. Go to EPF counter or EPF Kiosk or.

The evaluation will in turn assist members in making informed investment choices that correspond to their risk appetites. I-Lindung is a self-service platform within i-Akaun Member to facilitate the purchase of protection products under Members Protection Plan which allow members to withdraw funds from their Account 2 to purchase insurance and to participate in takaful products from EPF approved Insurance Companies and Takaful Operators. I-Invest doesnt require you to go through a unit trust consultant instead you can invest directly online.

Log in to i-Akaun Member 1. We are very excited about introducing i-Invest as this digitally powered facility. How to Create EPF i-Akaun For first-time login get the activation code first.

I-Invest - Employees Provident Fund. Call KWSP at 03-89226000. You can do this by.

Invest for FREE It used to be 3 now is 0. 2 Click Investment Transactions Buy. Ad Bei uns erhält jeder Kunde maximale Anlagequalität.

9 Landing Page. Via EPF i-Invest members of EPF may transfer up to 30 of the amount from their EPF Account 1 in excess of basic savings to be invested in funds approved under the EPF-MIS. Investment scheme Information on member investment scheme Information on unit trust investment.

All EPF members above the age of 18 are eligible to create an investing account. Combined with Eastspring Investments partnership and proven track record of award wins 2 members of EPF have the power to control and monitor their own investments. What are the steps to invest in Kenanga Investors funds using the EPF i-Invest.

Log into i-Akaun Select Investment tab to proceed Select Transaction and subsequently Buy tab Select Kenanga Investors Berhad on Please Select FMI Select your fund from Please Select Fund Enter amount and select Proceed to checkout. You can invest up to 30 of your savings in Account 1 if you have more than the necessary Basic Savings amount. Do text us 013-325 7653.

Minimum investment amount is RM1000. Minister of finance tengku datuk seri utama zafrul tengku abdul aziz in launching the epf i-lindung today said through the glc transformation programme implemented by the government to drive the recovery and rebuilding of the post-pandemic economy through the ecosystem of government linked companies glcs and government linked investment. Members above the age of 55 years old are still eligible to invest provided you have savings in your EPF Akaun 55 Akaun Emas.

Key in user ID and click Next. Then surf the EPF website to activate your i-Akaun before the expiry date. Register i-Akaun for Employer at the EPF website.

4 Select the fund s of your choice and key-in your desired investment amount. The protection offerings are available to EPF members with immediate effect. What are the benefits of investing via.

KUALA LUMPUR 12 July 2022.

Kwsp I Invest Self Service Investment Tool Adds New Features Leh Leo Radio News

Epf S I Invest Records Transactions Worth More Than Rm80m

How To Invest In Unit Trust With Epf Money Kwsp I Invest I Sinar Youtube

Epf I Invest Features You May Not Know About

How Epf Digitalising Its Customer Journey

Investment On Kwsp I Invest The Research Files

Epf Now Lets You Invest In Unit Trust Funds Directly Via I Akaun Portal Soyacincau

Epf Upgrades I Invest With New Features To Help Members Make Informed Investment Decisions

Epf Releases Revises List Of Unit Trust Funds Businesstoday

Evening 5 Epf Cuts Stake In Riverstone Video Dailymotion

No Cash For Investment You Can Withdraw Money From Your Epf Savings To Increase Saving For Retirement Members Can Invest 30 Of The Total Savings From Account 1 Into Investment Schemes Approved

Bernama Epf Enhances I Invest Portal With New Features To Help Members Make Informed Decisions

Investing In Malaysia Financial Freedom Financial Education And Planning Malaysia S Foremost Unit Trust Inve Financial Education Investing Financial Freedom

How To Diversify Grow Your Epf Savings Psst Tell Your Parents About It Too No Money Lah

Celebrating Success How Epf Digitalising Its Customer Journey

Epf Releases Revised List Of Unit Trust Funds For 2022 2023 Mywinet

0 Response to "epf i akaun investment"

Post a Comment